DreamBuilder

Plan

Discover product details

Do you have a Dream?

“The future belongs to those who believe in the beauty of their dreams”– Eleanor Roosevelt.

- Dream Big. Be Happy. You can achieve your Dream.

- How? Let us talk to about DreamBuilder.

At SanlamAllianz , we empower generations to be financially confident, secure and prosperous.

Dream and make it happen . Having a dream is good. Achieving your dream is better. Realising your dream while living a life of financial confidence is the best.

Our DreamBuilder Plan is designed to enable you to move your dreams to goals so we can help you to achieve your goals.

You can live a life of financial confidence knowing that your dreams will be achieved whether alive, called to “ eternal rest ” or permanently disabled .

Do you have a Dream?

“If your dreams don’t scare you, they are too small” Richard Branson.

Do you have goals connected to your Dream?

You can talk to us about your goals. Could it be to:

- Organise dream wedding?

- Buy a dream car?

- Go for a lifetime holiday?

- Build capital to invest in a business?

- Build a dream home?

When do you want to achieve your goal?

Please, consider whether you want to achieve your goal within a short term (5 years) or long-term (10 years and above)

How much will your goal cost to achieve?

“Dreams don’t work unless you do” - John C. Maxwell

DreamBuilder is designed to enable you work on and achieve on your dreams.

How does DreamBuilder Work?

Your DreamBuilder Plan will be customised to suit the financial value of your dream and aligned with the time you want to achieve your dream. Your DreamBuilder Plan will consider how much you are able to contribute per month.

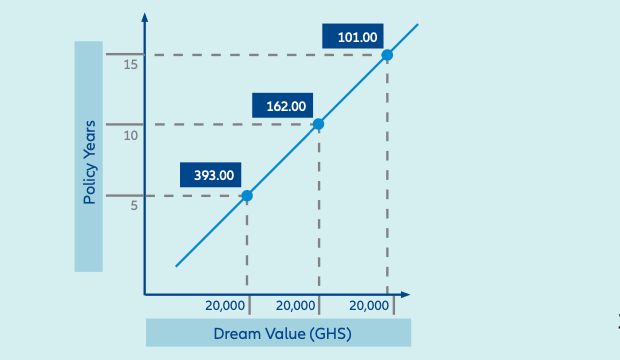

If your dream is valued at Ghs20,000 , the monthly premium you will pay is dependent on when you want to achieve your dream and your age. If you wish to achieve your dream in 5 years,10 years, 15 years at age 41 , your monthly premium is as shown in the graph below:

- If you wish to achieve your dream valued at Ghs20,000 in 5 years, your monthly premium will be Ghs393.

- If you wish to achieve your dream valued at Ghs20,000 in 10 years, your monthly premium will be Ghs162.

- If you wish to achieve your dream valued at Ghs20,000 in 15 years, your monthly premium will be Ghs101.

Benefits of your

DreamBuilder Policy

- You enjoy a life insurance cover (death and disability) worth Ghs20,000 at the start of the policy. Your dream is insured by the policy.

- Your DreamBuilder Policy has two investment pots in which your monthly savings contribu tions are allocated.

The Savings Pot and the Goal Achiever Pot. - 70% of your monthly savings premium is allocated to the goal achiever pot and 30% to the savings pot.

- You are free to withdraw 100% of the fund value twice each year from the savings pot after 24 months contribu tion subject to maintaining a minimum balance of Ghs500.

- The Goal Achiever pot fund value is payable at the maturity of the policy.

- At maturity, the Goal Achiever pot fund value is paid to the savings pot and 100% of the savings fund value is paid to the policyholder.

- In the event of death of the policyholder, the life cover amount, the savings pot fund value and the goal achiever pot fund value are paid to the beneficiary named by the policyholder under the policy.

- In the event of physical impairment of the policyholder, the cover amount will be paid. The policyholder has the option to request for the payment of the savings fund values or allow the savings fund to continue.

- The minimum term of DreamBuilder is 5 years and the maximum tenure is 40 years.

“A man is not old until regrets take the place of Dreams” – John Barrymore.

With DreamBuilder , your dreams will not become regrets. Please, start now so you can live a life of confidence to achieve your dreams.

Our job is to help you to achieve your dreams.

Key Features of DreamBuilder

- You can buy DreamBuilder if you are 18 years and not older than 65 years.

- The minimum cover amount offered by DreamBuilder is Ghs20,000 and the minimum monthly premium is Ghs100 with no limit on the monthly savings premium.

- SanlamAllianz Life shall waive and pay 3 months risk premiums excluding the savings premium to keep your cover active in the event of retrencment of the policyholder.

- The risk premium for the life cover under your policy is part of your monthly premium.

- Waiting period of 6 months applies at the start of the policy for payment of death and physical impairment benefits resulting from illness. No waiting period applies in the event of accidental death or accidental physical impairment.

- We care about the value of your benefits due to inflation. DreamBuilder policy has 10% mandato- ry annual premium increase. Your cover amount will increase by 7.5% annually subject to the payment of additional annual premium and the rest of the additional premium allocated to your savings pots. You have the option to increase the compulsory annual premium increase to 15%, 20%, 25% or 30% to mitigate the impact of inflation of your benefits.

- DreamBuilder offers a single premium payment option dependent on your age as per the table below:

Age Band | Minimum | Maximum |

18 – 50 | 15,000 | Unlimited |

51- 60 | 25,000 | Unlimited |

61 – 65 | 30,000 | Unlimited |

- When you chose the single pemium option, 50% of your single premium is allocated to the savings pot and 50% is allocated to you Goal Achiever pot.

The savings premiums of your DreamBuilder policy will be invested prudently by SanlamAllianz Life and the returns subject to investment management fee of 1.5% will be credited to your policy to grow your fund values.

Beneficiary

A beneficiary is the person to whom the cover amount together with the total fund values under the savings pot and the goal achiever pot will be paid in the event of death of the policyholder.

Our Service Commitment

We are committed to deliver on our promise to serve you with CARE ensuring everything we do leaves a lasting impact and legacy. SanlamAllianz Group has done this for over 200 years and continues to serve many 27 countries in Africa.

Your claim experience is very important to us.

Please, go to our care portal to make a claim or call us to assist you.

SanlamAllianz CarePortal

- Digitized service experience at your convenience

- Make a claim, upload documents, check on claim’s status

- Make premium payment and view payment history

- Download policy documents

- View and download your DreamBuilder Policy Statement

- Make changes including beneficiaries

- Available at your convenience (24/7 service)

Please, refer to your policy terms and conditions for the full terms and conditions of your DreamBuilder policy.

How can I sign on to

DreamBuilder ?

- We have digitized your on-boarding experience.

- A licensed Financial Advisor of our Company will assist you to purchase your DreamBuilder Plan using an end-to-end secure digitized process at any time of your convenience (24/7).

A one-time password shall be sent to you as part of the onboarding process. All policy documents shall be

sent you electronically