Income Protection

Insurance

Discover product details

Protect your salary against the risks that will take it away from the payroll.

Ability to earn income is the most important asset during our lifetime. Protection of your income if you become temporarily or permanent disabled is a necessity. The “call to eternal rest” of a breadwinner before retirement has direct negative impact on the welfare of the family.

Do you earn income? Is your income secured? Be it salary or income from business, the wellbeing of your family depends on this. The protection of your income is the essence of this plan.

- As a breadwinner, will your name be removed from the payroll of your employer in the event of death or permanent total disability?

- If you are self-employed, your inability to earn income resulting from disability or untimely “call to eternal rest” has direct impact on the welfare of yourself and family. Have you considered this?

- Will your employer continue to pay your monthly salary up to the retirement age of 60 in the event of death or permanent total disability before retirement?

- Have you considered the impact of the loss of income of your spouse in the event of their death or disability?

ABOUT

Discover product details

SanlamAllianz Income Protection Plan is designed to protect the income of breadwinners against the risks of death or disability through illness or accident to ensure sustainable income that lives to support the breadwinner and the family.

The cover amount is based on your annual income. The plan enables you to care for yourself and family irrespective of death or disability.

The plan is designed with two packages including:

- Classic Package

- Prestige Package

The minimum cover amount offered under the plan is Ghs50,000. The maximum cover amount is linked to multiples of your annual income subject to maximum cover amount of Ghs6 million, considering the number of years you have from policy start date to the selected retire- ment age.

The policy provide cover for your income before retirement.

The monthly premium payable under the policy is determined by consid- ering the cover amount selected, the age of the lives insured under the policy and the medical information obtained.

The plan is designed with tenure linked to the active working years of the breadwinner with minimum term of five (5) years. The policyholder has the option to select the policy end date at any age from age 60 to 65.

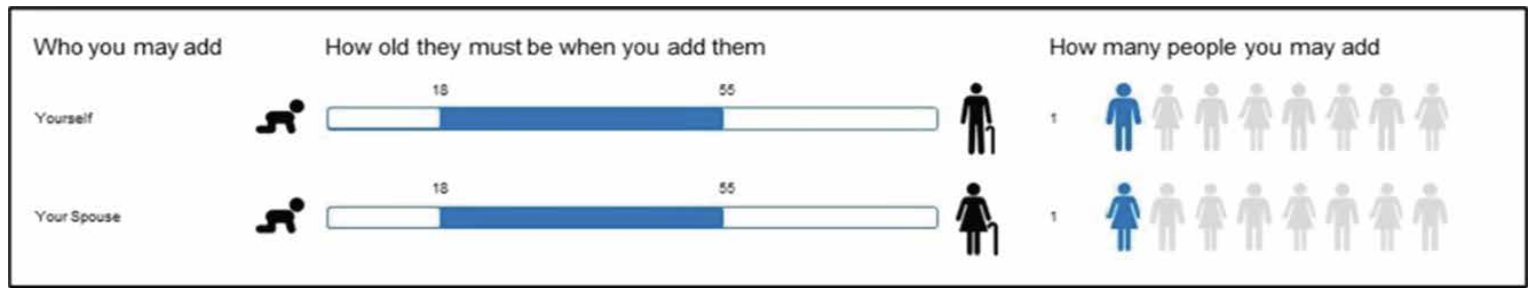

Yourself as breadwinner being the policyholder. The policy can be extended to your spouse.

The minimum age of entry is 18 years, and the maximum age of entry is 50/55 years.

KEY BENEFITS

Benefits of SanlamAllianz Income Protection Plan

Death Cover Benefit

The cover amount selected will be paid as lump sum in the event of death of the policyholder or spouse or both. Where savings option is selected, the fund value of the savings account will be paid in addition to the cover amount.

Permanent Disability Cover Benefit

The cover amount selected will be paid as lump sum in the event of permanent disability of the policyholder or covered spouse or both. The policy cover disability from accident as well as illness. Where the savings option is selected, the fund value of the savings account will be paid in addition to the cover amount.

Temporary Disability Cover Benefit

In the event of temporary disability of the policyholder or covered spouse, 10% of the cover amount is paid as lump sum.

Cash Back Benefit

The policy provides cash back benefit equal to 10% of the cover premium paid every 3 years once the policy is active.

Retrenchment Waiver of Premium Benefit

The cover premium under this policy will be waived for a period of 3 months if the policyholder or covered spouse is retrenched or while the policy is active. The cover remains in-force during the 3 months period. The savings premium is excluded under this benefit. This benefit is offered only under the prestige package.

Money Back Benefit

The policy pays the total cover premium paid at the end of the selected policy end date as money back benefit to the policyholder. This benefit is payable even if the policyholder made a temporary or permanent disability benefit claim under the policy. This benefit is offered only under the prestige package.

Savings Benefit

The plan has the saving option subject to minimum monthly contribution of Ghs20 into a savings account attached to the policy. The savings premium will be invested to generate returns for the policyholder.

The savings benefit provides withdrawal benefit every year, after the third year and at the policy end date. Up to 100% of the savings fund value can be withdrawn after every three (3) years from the start of the policy.

At the policy end date, the fund value of the savings account is paid.

Key Features

Automatic Annual Cover Increase

We care about the value of your cover due to the impact of inflation. The policy provides an automatic inflation protector of the cover amount selected from the effects of living expenses resulting from inflation. You have an option to increase the auto- matic annual premium increase for a higher increase of your cover amount to maintain the value of your cover amount.

The table below provides the annual premium increase options and the corresponding increase in cover amount.

| Percentage Premium Increase | Percentage Cover Amount Increase |

| 10% | Standard (7.5%) |

| 15% | 11.25% |

| 20% | 15.0% |

| 25% | |

| 30% | 22.5% |

Claims made Easy

We are committed to delivering our promise to serve you with CARE. SanlamAllianz has done this for over 100 years and continues to serve many in over 33 countries in Africa.

Your claim experience is very important to us.

Please, complete a claim form digitally or at any

SanlamAllianz Life Customer Care Centre nationwide or visit our

website: www.gh.sanlamallianz.com to download and complete the claim application form.

Feel free to email the completed claim application form together with supporting documents to us: care@gh.sanlamallianz.com

Please refer to your policy terms and conditions for required claims documents.

Waiting Period

Death, Permanent Disability Cover and Temporary Disability Cover benefits are subject to waiting period of six (6) months whereas retrenchment benefit is subject to waiting period of twelve (12) months with details in Terms and Conditions (T’s & C’s).